ABOUT PROGRAM

The Fundamentals of Sustainability Accounting (FSA) Credential provides professionals the tools to understand how sustainability factors drive financial outcomes, enabling them to make data-driven decisions for a positive impact.

Originally developed by SASB, the FSA Credential aims to teach professionals across various sectors how to identify, analyze, and effectively communicate the financial impacts of sustainability issues. Now under the IFRS Foundation, its core purpose remains the same: providing professionals with the tools to make informed decisions in the rapidly evolving world of sustainability reporting.

Why Now Is the Best Time to Do the FSA Credential

The world of business is rapidly shifting towards sustainability. Investors, clients, and regulators are demanding greater transparency and accountability regarding how companies address environmental, social, and governance (ESG) factors. This creates a huge demand for skilled professionals who can bridge the gap between sustainability concepts and financial analysis.

Here’s why the FSA Credential is your key to capitalizing on this shift:

-

- Position Yourself as a Leader: The FSA Credential verifies your deep understanding of sustainability accounting and its integral role in modern business. It sets you apart as a forward-thinking professional committed to integrating ESG awareness into financial decision-making.

- Gain in-Demand Skills: You’ll master the tools and frameworks necessary to analyze sustainability data, identify material ESG risks and opportunities, and integrate this knowledge into financial reports and models.

- Meet Investor Demand: Investors are increasingly looking to allocate capital to companies with strong ESG track records. The FSA Credential proves you understand how to identify and assess these factors, making you an invaluable asset to investors and the companies they support.

- Stay Ahead of Regulation: Global sustainability reporting standards are evolving and becoming more stringent. The FSA Credential gives you the foundation to navigate these changes, ensuring your expertise remains up-to-date and relevant.

The FSA Credential isn’t just about knowledge; it’s about shaping the future of finance. Seize this opportunity to be at the forefront of a rapidly transforming industry.

https://www.ifrs.org/products-and-services/sustainability-products-and-services/fsa-credential/

ENTRY REQUIREMENT

- There are no educational or professional prerequisites needed to register for the exam.

- Noesis recommends that candidates possess a bachelor’s degree (preferably in Finance/Mathematics/Statistics/Actuarial Science)

PRACTICAL EXPERIENCE REQUIREMENT (PER)

To qualify for the FSA® Credential, you must complete and pass both the FSA Credential Level I and Level II exams.

COURSE STRUCTURE

The FSA® Credential Program is suitable for candidates from graduates to working professionals.

| Contact Hours | Level I Exam The Level I exam covers on the principles:

|

Level II Exam The Level II exam focuses on the applications:

|

| Intake | March (May-June exam) July (Sep-Oct exam) November (Jan-Feb exam) |

March (May-June exam) July (Sep-Oct exam) November (Jan-Feb exam) |

| Duration | 2 months | 2 months |

| Study Mode | KL Face-to-Face | Blended Online |

| Contact Hours | 24 hours of lecture 3 hours of revision 1 mock exam |

24 hours of lecture 3 hours of revision 1 mock exam |

EXAM STRUCTURE

| Exams | Format | Availability | Base | Length | Location |

| Level I Exam | 110 MCQs | Jan-Feb May-Jun Sep-Oct |

Computer based testing | 2 hours | Pearson VUE Test Centre |

| Level II Exam | 55 MCQs (13 mini case studies) | Jan-Feb May-Jun Sep-Oct |

The FSA Credential Exam process is sequential. Candidates must pass the Level I exam before they can sit for the Level II exam.

IMPORTANT PROGRAMME DATES

*Exam is on-demand, candidates can sign up anytime. One standard fee for each level

FEE STRUCTURE

| Course Fee payable to Noesis | |

| Registration Fee (one-off) | RM 500 |

| Course fee per level | RM 3,000 |

| Repeating fee per level | RM 1,500 |

Note:

• IFRS Sustainability Alliance members receive US$50 off Level I exam registration and US$150 off Level II exam registration.

• AICPA & CIMA members receive US$50 off Level I exam registration and US$150 off Level II exam registration.

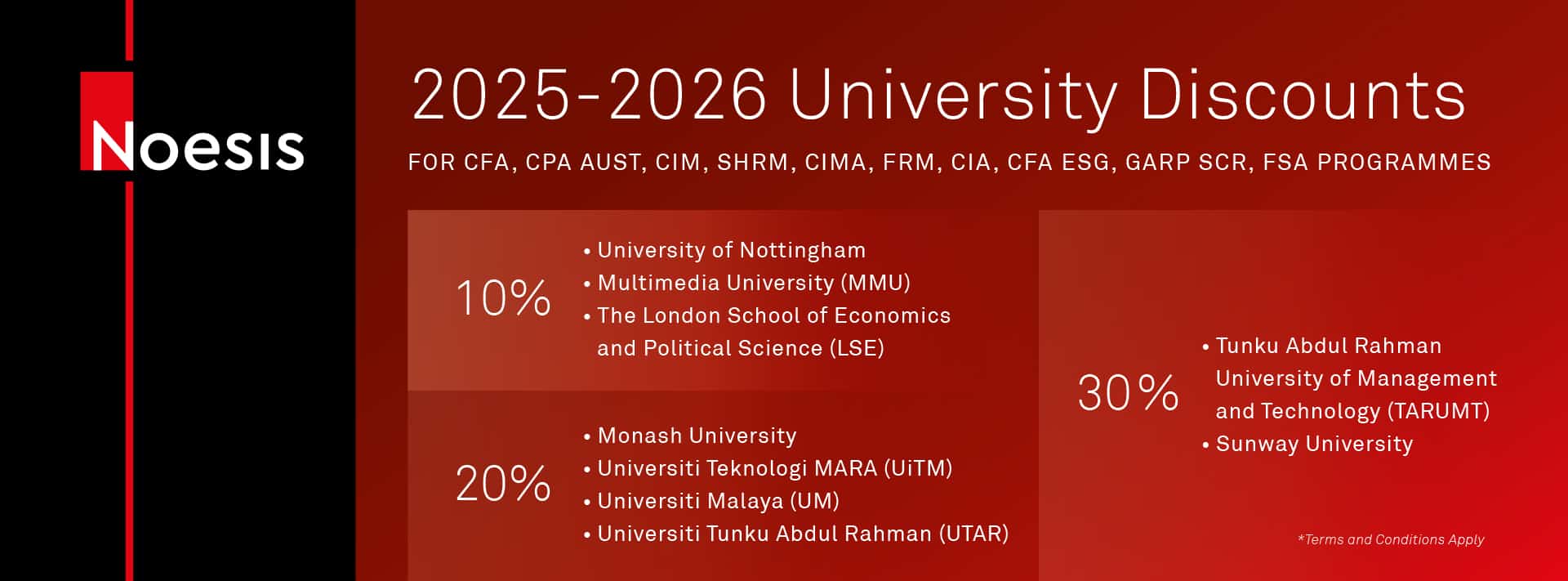

UNIVERSITY DISCOUNT

LECTURER PROFILES

Noesis prides itself on the quality of its lecturers across all programs.

The profile of some of our FSA Credential lecturers are below: