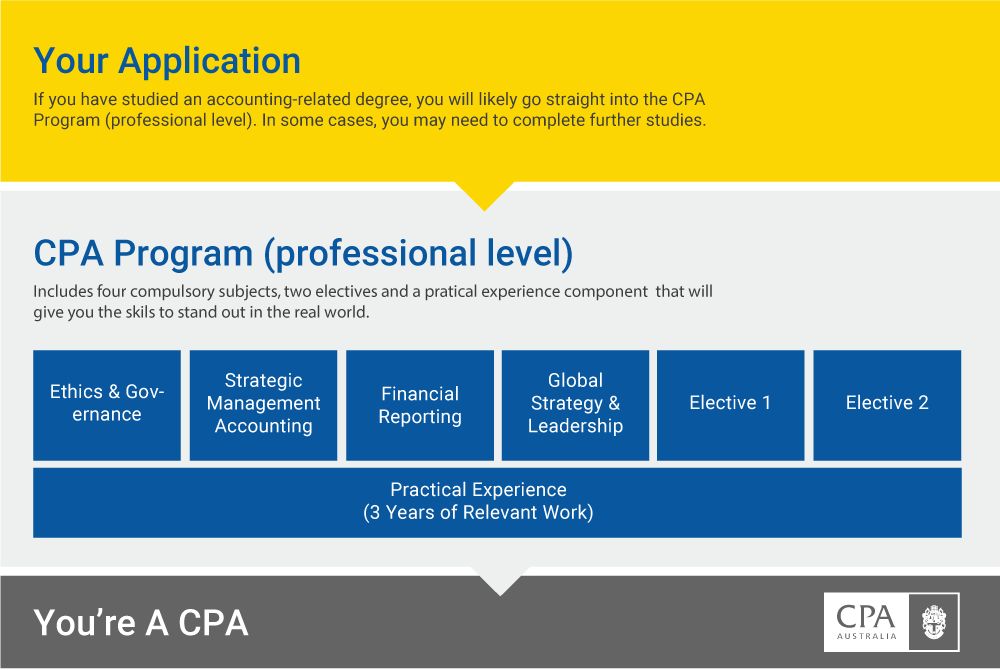

ABOUT CPA PROGRAM

CPA Australia is one of the world’s largest accounting bodies with a global membership of more than 164,695 members (as at 31 December 2018) working in 150 countries and regions around the world. A large number of CPA Australia members hold senior leadership roles, and a large proportion of these operate at CEO or CFO level or as business owners. The CPA (Certified Practising Accountant) designation is recognised throughout the world and denotes a combination of strategic business skill and leadership as well as technical rigour. It shows that the holder has a sound knowledge of accounting and finance in terms of depth, breadth and quality. The CPA Australia Program is a rigorous, educational and experience-based program, comprising a mix of educational segments and integrated workplace learning.

ENTRY REQUIREMENT

- A degree level qualification recognised by CPA Australia.

The list do accredited courses can be found in www.cpaaustralia.com.au. - Your degree can be completed while you are studying the CPA Australia Program.

- Foundation exams will be required for applicants that do not have a recognised degree.

- At least five years in a relevant accounting, finance, or business role, as well as holding a recognised qualification.

- Recent working experience of at least five years that demonstrates core competencies.

- A degree-level qualification or equivalent as recognized by CPA Australia (or will have completed one prior to advancing to CPA status).

- C-suite/executive leaders with a minimum of 10 years of leadership and work experience in accounting or finance.

- Minimum of three (3) years in a C-suite/executive management role in accounting or finance. Please note: This can include the 10-year requirement.

- A reference/testimonial from a current CPA or International Federation of Accountants (IFAC) member as part of the application process.

- The general admission criteria are fit and proper, a public practice certificate (where required), and supporting documentation.

- A degree-level qualification or equivalent as recognized by CPA Australia (or will have completed one prior to advancing to CPA status

- Successfully meet CPA Australia’s admission requirements.

- Successfully completing the CPA Program subject of Ethics and Governance in order to advance to CPA status.

PRACTICAL WORK EXPERIENCE

- Complete a minimum of three years of relevant work experience.

- Demonstrate competence in the necessary technical, business, personal effectiveness and leadership skills.

- You will need a mentor who is a CPA, FCPA or IFAC member to review your experience and sign-off the time period that you’re claiming and the skills that you’ve acquired.

- Previous relevant experience can be recognised before, during or after you’ve finished the professional education component.

COURSE STRUCTURE

Compulsory Subjects

|

Intake Period

February / July

|

Duration

3 months per semester

|

Study Mode

– KL Face-to-Face/Live Webinar

– Blended Online |

Most students complete this segment first. This segment raises your awareness of various ethical, moral and practical considerations you may face as an accountant, and equips you with a value framework that will help you to act in the public interest. This commitment to integrity is one of things that sets the CPA apart from other accountancy qualifications.

|

Intake Period

February / July

|

Duration

3 months per semester

|

Study Mode

– KL Face-to-Face/Live Webinar

– Blended Online |

Financial reporting is of course primarily important to determine an organisation’s financial performance and position. But as a CPA member, you will come to see it also as a means of communicating with investors, customers, suppliers and regulators. Taking financial reporting beyond compliance will help push your career further.

|

Intake Period

February / July

|

Duration

3 months per semester

|

Study Mode

– KL Face-to-Face/Live Webinar

– Blended Online |

This segment teaches effective planning, measuring, analysis and communication in a global business environment. It shows you how to contribute to strategy development and implementation to secure a stronger competitive position for your organisation. In short, it provides you with the skills you need to get ahead.

|

Intake Period

February / July

|

Duration

3 months per semester

|

Study Mode

– KL Face-to-Face/Live Webinar

– Blended Online |

This segment consolidates the knowledge you will have gained in the other three compulsory segments. In an increasingly complex business environment, characterised by change, uncertainty and escalating competition, the disciplines of strategy and leadership are now more relevant than ever.

Elective Subject

|

Intake Period

February

|

Duration

3 months per semester

|

Study Mode

– Blended Online

|

Accounting as a discipline continues to evolve to meet the changing needs of society. For example, the accounting profession has been at the forefront in establishing emissions trading schemes and carbon credits, a notion unheard of a decade ago. This segment examines new issues, providing an opportunity for consideration and discussion of the role of the CPA in contemporary business.

|

Intake Period

February

|

Duration

3 months per semester

|

Study Mode

– Blended Online

|

The audit and assurance process is more than just compliance. This segment takes you through the process of both auditor and client, giving you an awareness of internal and external assurance services that can determine the future of a business.

|

Intake Period

July

|

Duration

3 months per semester

|

Study Mode

– Blended Online

|

The global financial crisis has highlighted the key role that ethical, independent accountants have to play in managing risk and risk-laden assets. This segment equips you to recognize the financial risks faced by both small and large corporations in utilising, and in complying with international reporting requirements relating to, derivatives and hedging. It also equips you to put measures in place to manage risk.

Contact Hours

|

KL Face-to-Face/Live Webinar

|

Blended Online

|

|

|

Core Classes

|

32 hours

|

Videos + 9 – 15 hrs Tutorial*

|

|

Intensive Revision Course

|

4 hrs

|

4 hrs*

|

|

Mock Exam

|

3 hrs

|

3 hrs

|

- *Video Conference

EXAM STRUCTURE

| Compulsory Modules | Elective Modules |

| Combination of multiple-choice and extended-response questions | 100 per cent multiple-choice questions |

IMPORTANT PROGRAMME DATES

| Date | Description |

| 10 June 2025 | Enrolment opens |

| 10 June 2025 | Exam scheduling opens |

| 9 July 2025 | Early bird enrolment closing date |

| 22 July 2025 | Final enrolment closing date |

| 21 July 2025 | Semester starts |

| 28 July 2025 | Closing date for exam scheduling or rescheduling |

| 1 October – 19 October 2025 | Exam period |

| 28 November 2025 | Exam results released via the CPA Australia website |

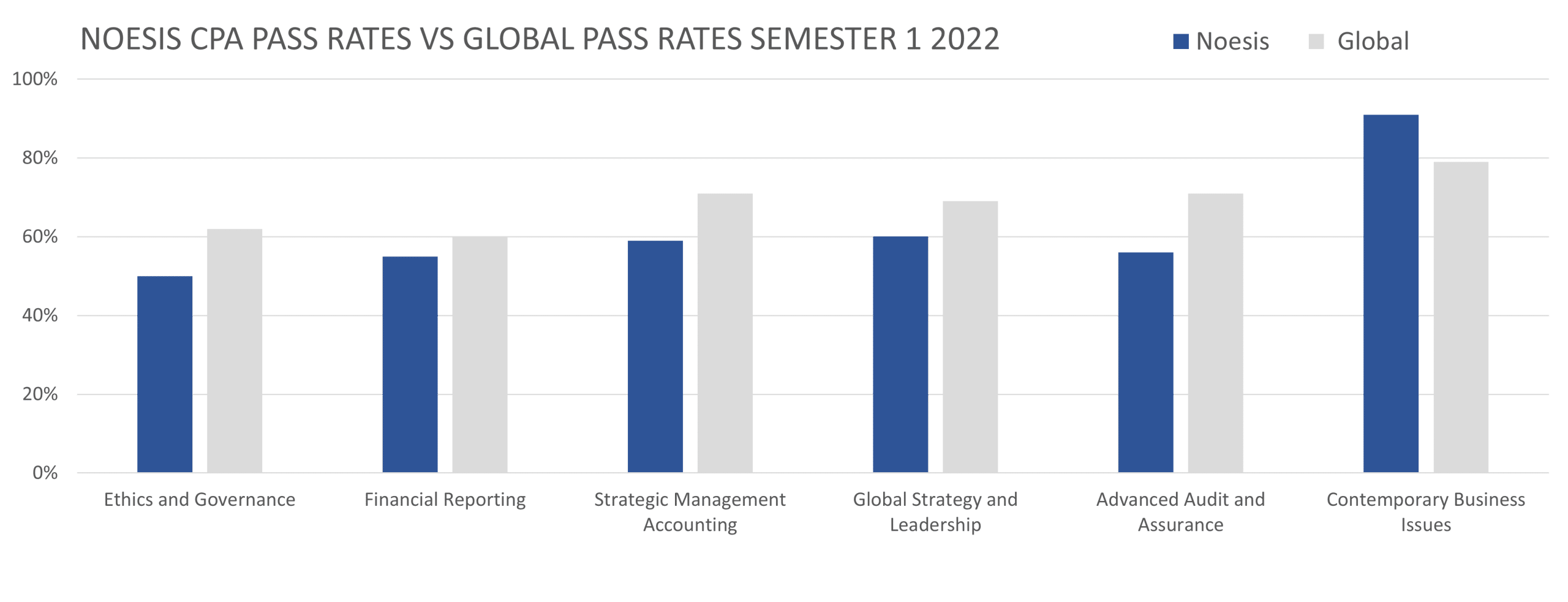

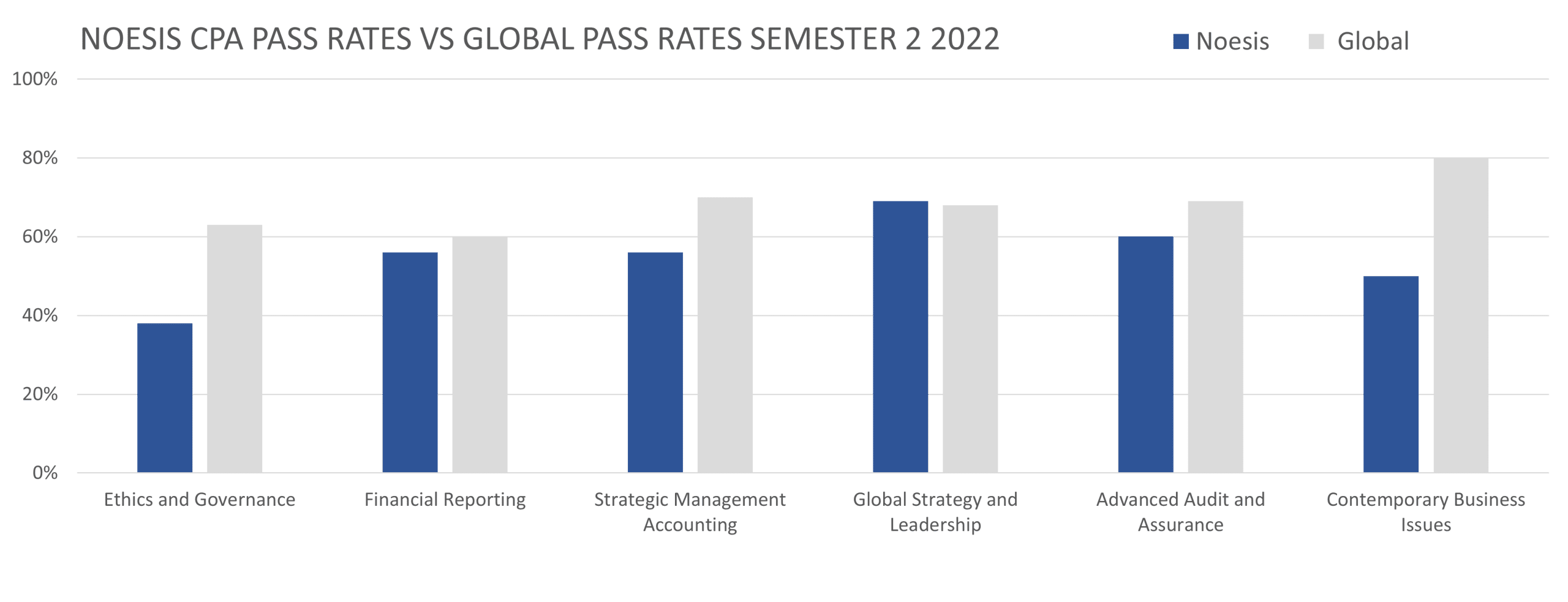

PASS RATES

COURSE FEE

| Fees payable to Noesis Exed Sdn Bhd | |||||||

| 1) KL Face-to-Face Study Mode Fees: | |||||||

| CPA estimated cost of completion (Ringgit Malaysia) | |||||||

| Sem 1 | Sem 2 | Sem 3 | Sem 4 | Sem 5 | Sem 6 | Total | |

| Registration fee | 500 | 500 | |||||

| Tuition fee | |||||||

| 1st Subject | 3,500 | 3,500 | |||||

| 2nd Subject | 3,150 | 3,150 | |||||

| 3rd Subject | 2,800 | 2,800 | |||||

| 4th Subject | 2,450 | 2,450 | |||||

| 5th Subject | 2,100 | 2,100 | |||||

| 6th Subject | 1,750 | 1,750 | |||||

| Total fees payable to Noesis | 16,250 | ||||||

|

Executive Leadership Pathway

|

|

|

Noesis Registration Fee

|

RM500

|

|

Tuition Fee

|

RM5,000 (Ethics and Governance)

|

| 2)Singapore Online Study Mode Fees: | ||

| Mode | Registration Fee | Course Fee |

| Singapore Online | SGD150 | SGD850 (first subject) |

EXAM FEE

| Fees payable to CPA Australia (Subject to change) | ||

| 2025 (Malaysia) | 2025 (Global) | |

| Application Fee | MYR 631 | AUD 200 |

| Subject Fee (Early Bird) | MYR 3017 | AUD 1382 |

| Subject Fee (Normal Rate) | MYR 3401 | AUD 1588 |

| Membership Fee – ASA | MYR 823 | AUD 354 |

| Membership Fee – CPA | MYR 2271 | AUD 866.50 |

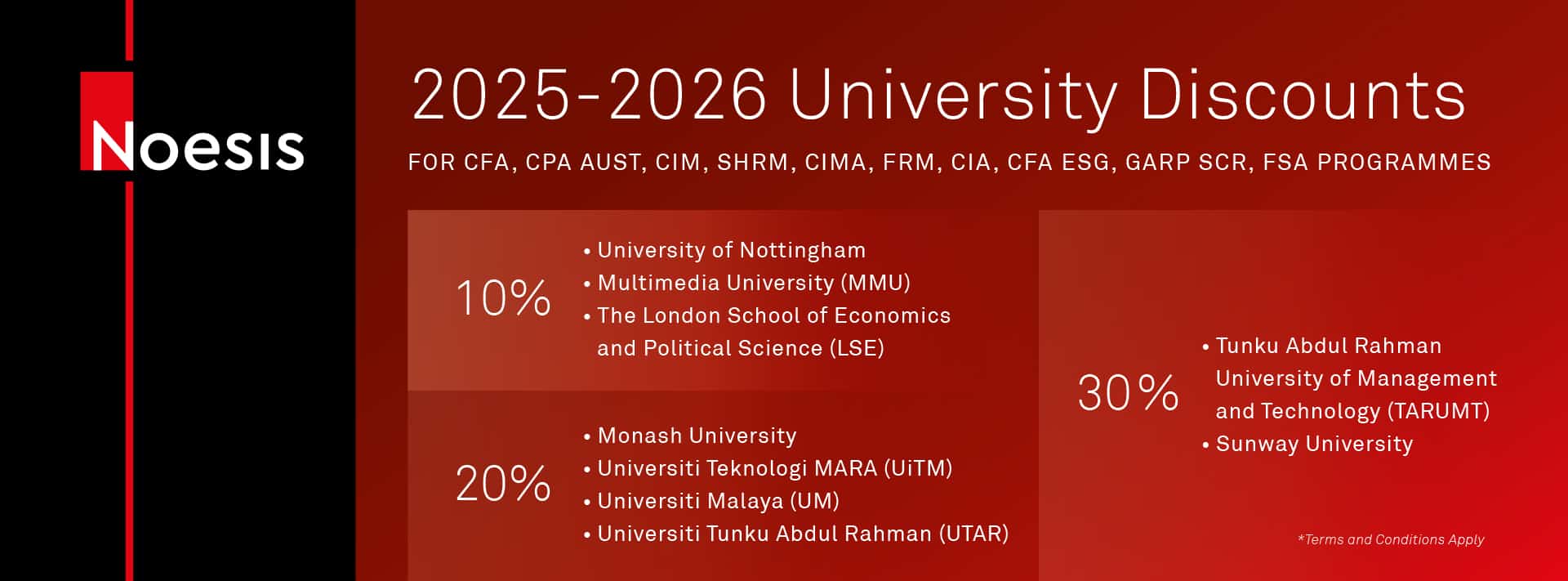

UNIVERSITY DISCOUNT

LECTURER PROFILES

Noesis prides itself on the quality of its lecturers across all programs.

The profile of some of our CPA Australia lecturers are below: