ABOUT PROGRAM

The Financial Risk Manager (FRM®) is the global standard for financial risk. It was developed by the world’s leading risk practitioners; the designation signifies a mastery of the skills and knowledge needed to help organizations succeed in today’s rapidly changing financial landscape. Its curriculum is updated annually by a group of distinguished risk professionals and leading academics from diverse backgrounds, ensuring that the designation meets the evolving demands of the global financial industry.

Currently, more than 70,000 certified FRMs are employed at nearly every major bank, asset management firm, hedge fund, consulting firm, and regulator around the world. FRM registrations have grown by an average of 15% per year since 2010, surpassing 83,000 in 2020. This growth reflects the rapidly increasing demand for professionals trained in measuring and managing financial risk.

By achieving the FRM Certification, candidates join a worldwide network of professionals in more than 190 countries and territories, greatly expanding their professional development opportunities. Moreover, employers know that FRMs have the knowledge needed to anticipate and respond to critical issues, providing them with an edge in a competitive professional landscape.

Benefits of the FRM:

- Demonstrate your knowledge

Earning your certification shows that you have mastered the knowledge bases necessary to effectively assess and manage risk. - Highlight your experience

The designation testifies that you have worked in the profession for at least two years, signaling to employers that you have the experience necessary to succeed. - Join an elite group

You’ll be part of a network of like-minded professionals, allowing you to expand your career opportunities. - Underscore your reliability

Because all FRMs are expected to adhere to the GARP Code of Conduct, employers know that FRMs will help safeguard their firm’s reputation.

https://www.garp.org/frm

ENTRY REQUIREMENT

- There are no educational or professional prerequisites needed to register for the FRM Exam.

- Noesis recommends that candidates possess a bachelor’s degree (preferably in Finance/Mathematics/Statistics/Actuarial Science)

PRACTICAL EXPERIENCE REQUIREMENT (PER)

To qualify for the FRM®designation, you must complete and pass both FRM Exam Part I and Part II. After that, candidates must submit two years’ (24 months’) of full-time work experience in finance or a related field to complete their certification. This full-time work experience can be accrued before or after you pass your Exams. A candidate has five years to submit their work experience after passing the FRM Exam Part II.

COURSE STRUCTURE

The FRM® Program is suitable for candidates from graduates to working professionals.

| Contact Hours | FRM® PART I The FRM Exam Part I covers the tools used to assess financial risk:

|

FRM® PART II The FRM Exam Part II focuses on the application of the tools acquired in the FRM Exam Part I through a deeper exploration of:

|

| Intake | July Intake (November Exam) | January Intake (August Exam) |

| Duration | 5 months | 7 months |

| Study Mode | Blended Online | Blended Online |

| Contact Hours | Lecture videos (62 chapters) 22 hours of online tutorial 24 hours of online intensive revision course 4 progress tests (1 progress test per section x 4 sections) 2 mock exams |

Lecture videos (104 chapters) 31 hours of online tutorial 27 hours of online intensive revision course 6 progress tests (1 progress test per section x 6 sections) 2 mock exams |

EXAM STRUCTURE

| Exams | Format | Availability | Base | Length | Location |

| FRM® PART I | 100 MCQs | May / Aug / Nov | Computer based testing | 4 hours | PSI |

| FRM® PART II | 80 MCQs | May / Aug / Nov |

The FRM Exam process is sequential. Candidates must pass Exam Part I before their Exam Part II will be graded.

Candidates that take Exam Part II prior to receiving a passing score on Exam Part I (e.g., candidates that take Exam Part II in the same month that they take Exam Part I) will not have their Exam Part II graded if they fail Exam Part I. Candidates must take and pass Part II within four years of passing Part I.

IMPORTANT PROGRAMME DATES

*For future updates and exact dates, kindly visit https://www.garp.org/frm/exam-logistics

FEE STRUCTURE

| Course Fee payable to Noesis | |

| Registration Fee (one-off) | RM 500 |

| Course fee per level | RM 5,200 |

| Repeating fee per level | RM 2,600 |

*For professional and exam fees payable to GARP, kindly visit https://www.garp.org/frm/fees-payments

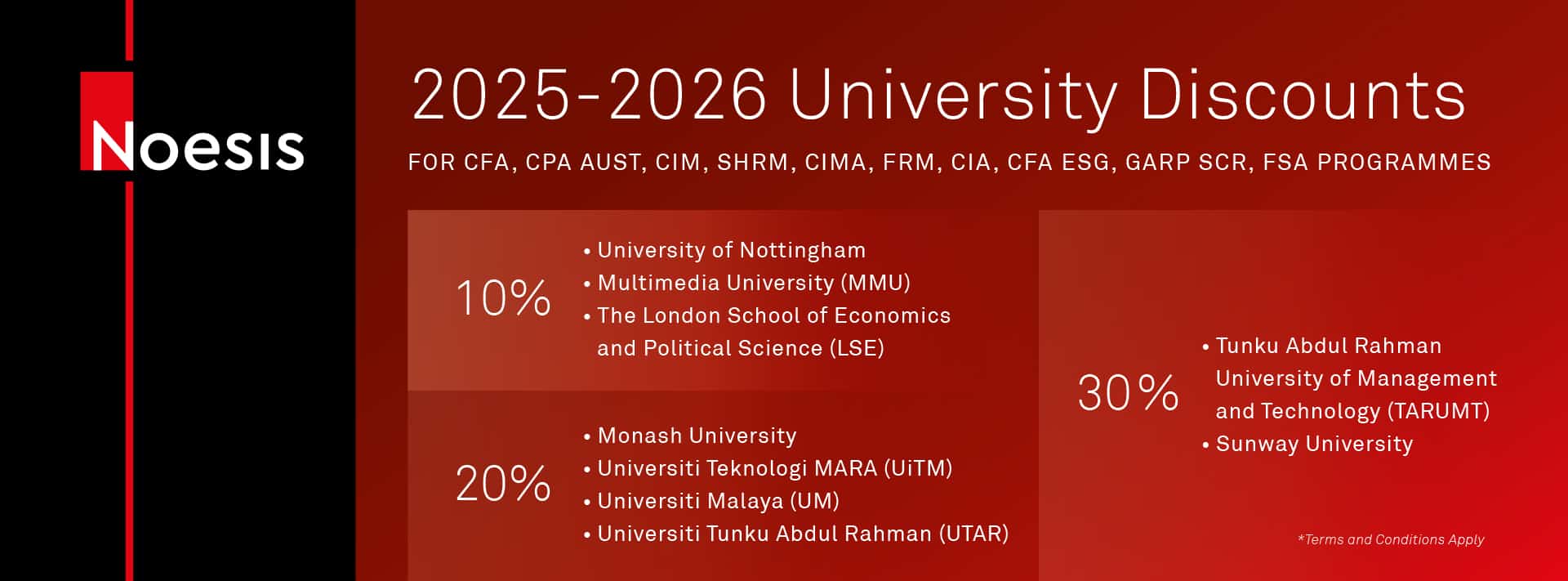

UNIVERSITY DISCOUNT

GARP does not endorse, promote, review or warrant the accuracy of the products or services offered by Noesis Exed of GARP Exam related information, nor does it endorse any pass rates that may be claimed by Noesis Exed. Further, GARP is not responsible for any fees or costs paid by the user to Noesis Exed nor is GARP responsible for any fees or costs of any person or entity providing any services to Noesis Exed. SCR®, FRM®, GARP® and Global Association of Risk Professionals™, in standard character and/or stylized form, are trademarks owned by the Global Association of Risk Professionals, Inc.

LECTURER PROFILES

Noesis prides itself on the quality of its lecturers across all programs.

The profile of some of our FRM lecturers are below: